With Retail Re-Opening, Media Planning Matters More than Ever

08/03/2020

As states allow retail businesses to re-open their physical stores, retailers are faced with a new dilemma: what is the best way to ramp up marketing investments to get consumers back in their stores? Compounding this problem is the matter of timing: if brands ramp too soon, they risk losing money with poor performance; if they ramp up too late, they will miss a competitive opportunity and will yield lower sales. The risks are real: retailers cut their marketing spend deeply to conserve cash and need to be extra cautious as they consider ramping up again.

Furthermore, using historical performance to guide these decisions is no longer useful. What worked pre-pandemic isn’t necessarily going to work now, as consumer purchase behaviors have made tectonic shifts over the last several months. Additionally, consumer media consumption has seen similar disruption and historically reliable ways of reaching target consumers may no longer hold.

So, what is a retail brand to do? Just as the pandemic has disrupted retail marketing, retail brands must disrupt their traditional ways of marketing and media planning. Traditional— and most current—media planning focuses on reach and frequency of advertising but completely ignores the question of what incremental sales are contributed by the investments. Furthermore, most media planning today doesn’t look at the e-commerce versus in-store impacts of these campaigns. This matters much more now as retailers are faced with a sharp dichotomy in their e-commerce and in-store channels. As they re-open physical stores, their working spend must work harder— and smarter—than ever to preserve their burgeoning online businesses while helping revive their physical store revenues. To do this successfully requires advanced analytics that measure these disparate hard-dollar impacts.

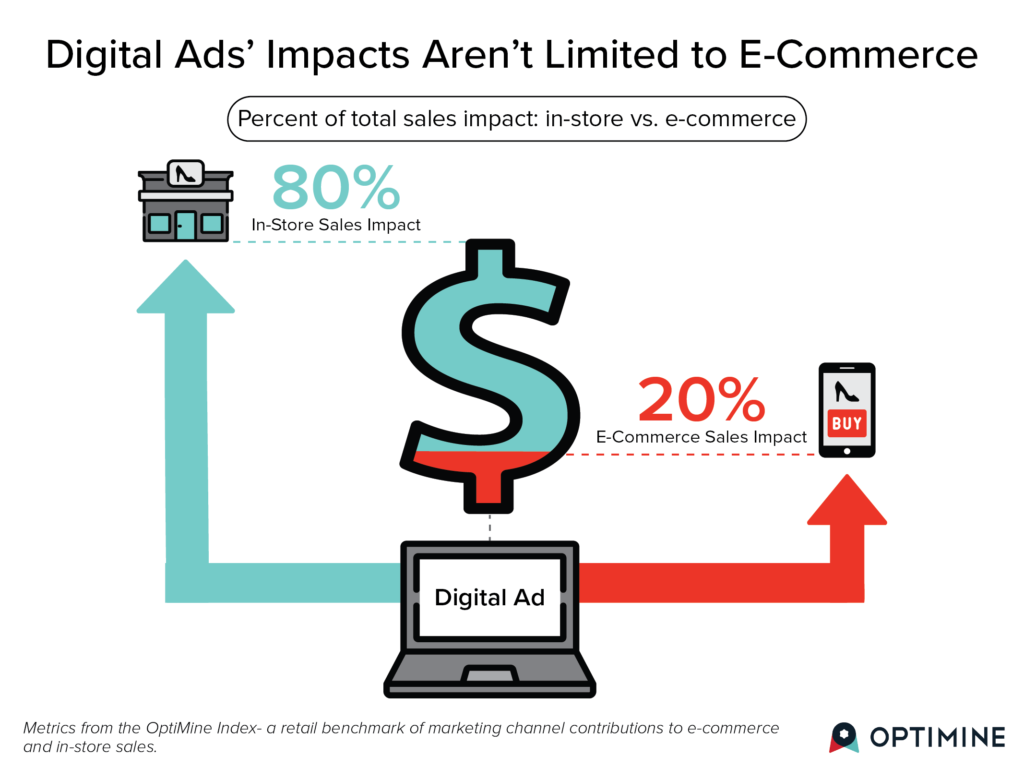

This type of sophisticated analytics-driven planning is core to OptiMine’s approach. When the pandemic hit, OptiMine quickly began advising its clients on media contributions to online vs. offline revenues. Also, OptiMine’s cross-channel attribution models were updated frequently to account for rapid consumer behavior changes driven by the pandemic. From across its client base, OptiMine is now able to share valuable insights and benchmarks on how media impacts e-commerce versus in-store. Digital campaigns’ sales impact is much larger for in-store where 80% of its total impact is on in-store sales while its e-commerce impact is only 20% of its total.

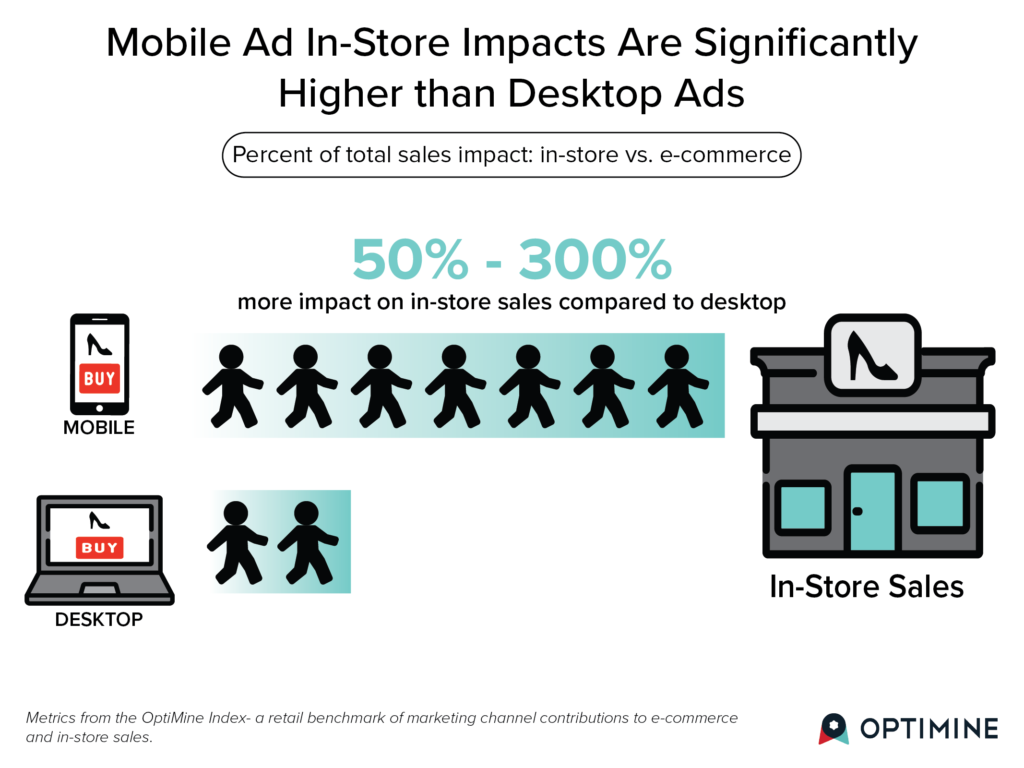

Mobile Ad In-Store Impacts Are Significantly Higher than Desktop Ads

When the pandemic hit, OptiMine quickly began advising its clients with sophisticated, analytics-driven planning to assist with rapid-cycle marketing spend adjustments as physical stores shut down. Whether it’s e-commerce vs. in-store, mobile vs. desktop, or a large variety of other breakdowns, OptiMine provides a retail benchmark on these contributions by major advertising channel. The infographic below shows how mobile ads have a much greater impact on in-store sales compared to desktop advertisements— just one of the many ways that retailers can boost traffic in their brick and mortar locations.

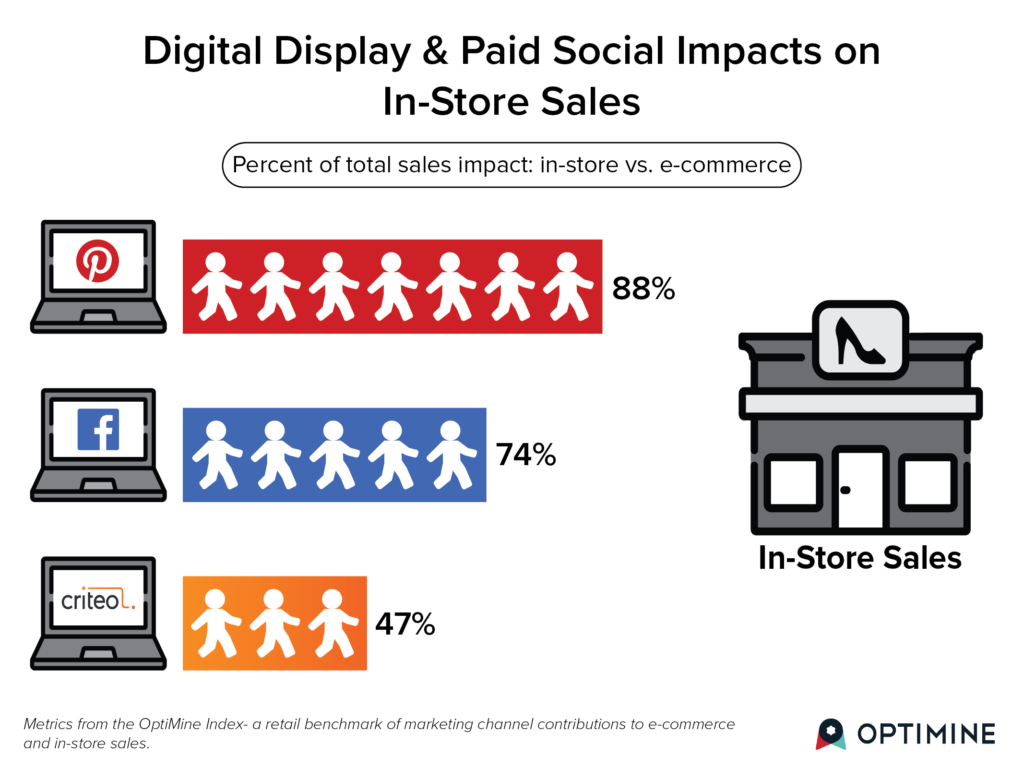

Digital Display & Paid Social Impacts on In-Store Sales

With the effects of the pandemic hitting retailers, OptiMine has been continuously advising our clients with sophisticated attribution analytics to help drive spend allocations targeted to rapidly changing circumstances. In this ‘Retail Re-Opening” series, OptiMine shares benchmark learnings on the in-store contributions by major advertising channel. The infographic below shows how different digital advertising platforms have varying impacts on in-store sales, with Pinterest coming out on top— just another one of the many ways that retailers can boost traffic in their physical stores.

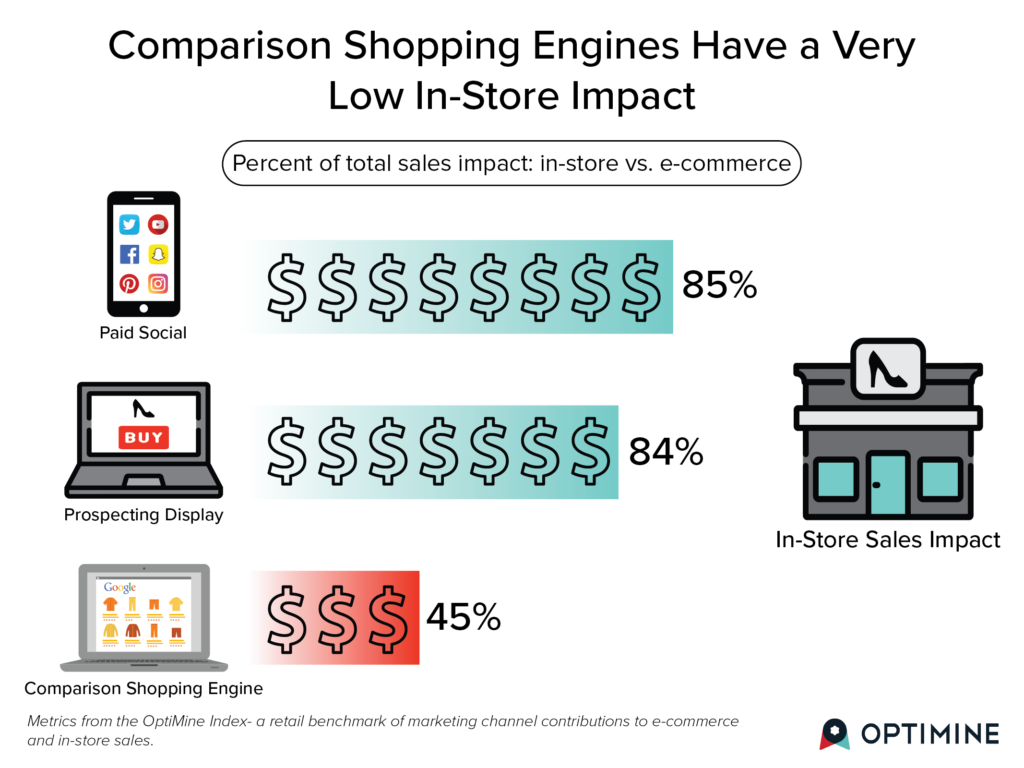

Comparison Shopping Engines Have a Very Low In-Store Impact

OptiMine is frequently asked which channels are best and which are weakest at driving in-store sales. The key, of course, is to be able to measure the full effects of a campaign across both e-commerce and in-store effects. One channel that generally generates a lot of last-click credit is Google Shopping. No surprise given that it captures a lot of lower funnel credit by reaching consumers actively in purchase mode. The question is this: does this channel also drive in-store sales? OptiMine’s benchmark analytics show that there are better options to invest in. The reason? Most of the impact of comparison shopping engines such as Google Shopping is found in e-commerce sales, while other channels such as social and display have a much greater portion of ROI generated in brick-and-mortar purchases. The infographic below shows the relative ratios of e-commerce and in-store effects of leading digital channels— just another one of the many ways that retailers can leverage OptiMine’s analytics to boost traffic in their brick and mortar locations.

Want to learn more? OptiMine has published an eBook guide that outlines the various performance of in-store impacts of leading digital advertising channels. You can download the guide here.