Marketing Predictions for 2023: More Uncertainty, Opportunities for the Agile

12/02/2022

It’s that time of year again, where pundits proudly prognosticate and predict what’s to come in the new year. OptiMine is throwing our hat into the ring with our own predictions for 2023 with a focus on marketing and analytics and where we believe the market will go next.

Predictions are always unpredictable, but the certainty for 2023 is uncertainty. Confused? So are most marketers. This has to be one of the most complex and challenging times for marketers as we all face significant economic anxiety that is putting huge pressures on budgets, all with a backdrop of rapidly changing consumer behavior, multi-channel complexity, and a wave of consumer privacy that is disrupting traditional marketing methods.

So, here goes. Here are our predictions for 2023:

1. Google will finally break the cookie (and won’t delay the death of the cookie any longer)

If you’ve grown accustomed to the continual delays from Google on the soft spoken of death of the cookie, nobody could blame you. But don’t count on any more reprieves. Google’s privacy sandbox is moving into expanded industry partner testing and this will continue to ramp up in 2023. They’ve given themselves, and more importantly, the marketing industry, enough time to test, adapt and validate. Google has also been listening to the industry by adapting their approach.

While the death of the cookie now has much less impact on marketing attribution, there’s one giant detail that is buried in Google’s planned changes: they will no longer allow individual user tracking in Chrome. So, if your multi-touch attribution solution relies on the ability to track an impression in the Google ecosystem and match that person’s identity to conversions, you will no longer be able to do so moving forward. The time is now to begin making plans for your next measurement solution.

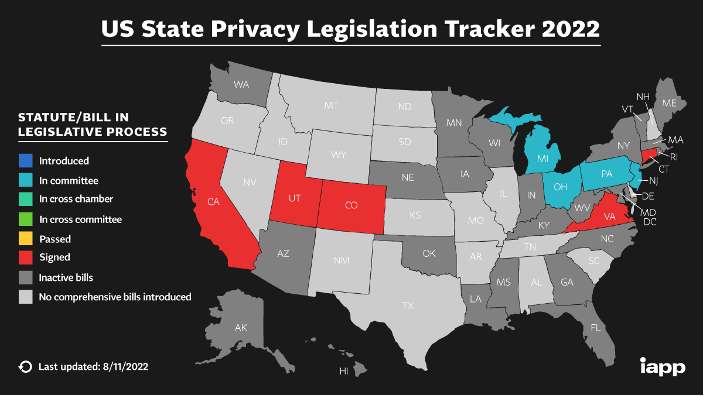

2. State-by-state privacy regulations will continue to mushroom, but still no federal privacy standard

Despite deeply divided politics in the US, there is one issue that seems to have strong bipartisan agreement: consumer privacy. The political alignment is so strong that several states currently have new privacy regulations moving through their regulatory pipelines.

We can expect more states to come online with their own unique versions of consumer privacy rights, with each state doing something different and unique. This will create more complexity for brands and more fits for their compliance teams (if they even have them…). More regulated industries such as insurance, health care and financial services will navigate these privacy changes more easily than other verticals because they have already invested in talent and infrastructure to deal with regulatory challenges.

Despite the explosion of complexity at the state-level, OptiMine predicts that there will be no action at the Federal level in 2023 as priorities shift with a new Congress- even though the two parties generally align on privacy. We can all hope for clarity at the Federal level, but it will likely take an industry outcry as the state-level complexity hits untenable levels. But this won’t happen in 2023.

3. Twitter—as we know it currently— will cease to exist

What a shock: it turns out that companies actually care about brand safety. Who knew? All kidding aside, this is no laughing matter. The slow-motion $44B crash and the resulting public spectacle hides the impact to people’s careers, and the lost promise of being a beacon of truth, transparency, and accountability in the modern public square.

Now, back to brand safety: it turns out that this IS critical, and large advertisers will move their dollars elsewhere, draining Twitter’s revenues very quickly. Musk & team seem to be making the bet that the way to save the company is to move to a subscription-based model, but how many Twitter users will pony up the $8 monthly fee? The answer: not enough. The result will be a much, much smaller Twitter, with a lot fewer advertisers and a lot less ad revenue.

One issue that Twitter has had historically is an inability to prove value to large advertisers. This is a measurement challenge that has resulted in large brands viewing Twitter as a less-than-essential element in their budgets, making the brand safety walk-away all too easy a decision. It’s unfortunate: OptiMine’s own measurement work with Twitter shows that smart brands can invest in paid and promoted Tweets and drive up favorability and drive down negative sentiment. Sometimes you just need to use a better measurement approach to see this— see our case study here.

4. AR/VR-based marketing will continue a very slow adoption curve

Admittedly, we’re not really going out on a limb on this prediction. We’re still missing the major “killer app” for AR/VR to drive mass consumer adoption, unless you consider online gaming part of “AR/VR”, which has already delivered several killer apps—just without the goggles and gloves. With the resulting lack of eyeballs comes a corresponding lack of advertising investment. If you take the VR headset out of the equation, the vision becomes clear: online gaming has a maturing advertising ecosystem and economy and can be a fantastic way to reach hard-to-reach young adults, but it isn’t driving AR/VR hardware sales.

Who knows what will drive adoption of next-gen AR/VR hardware? But when it happens, we’ll all point to the one app -whatever it will be- and say it drove the revolution. Side bet: it won’t be Horizon Worlds. Until then, marketers will stay on the sidelines.

5. Retail media networks will proliferate, creating both opportunity and enormous complexity for brands

Profit-challenged retailers have discovered the pot of gold sitting under their servers all along: their consumer data. As brands lose the ability to track and target consumers, they will seek to regain these abilities by partnering with their retail channel. Retailers will grow their adtech tools, skills and experience to become a new, dominant “advertising channel” of their own. This has already happened with Amazon, and other large retailers such as Target, Best Buy and others have launched their networks some time ago, so this isn’t new news. But other retailers will enter the game and this space will see enormous growth.

While having plenty of upside, the downside for brands is that there will be a large channel proliferation with each retail media network representing a major new channel to test, learn and adopt. Brands will face extra overhead trying to manage an expanding portfolio of retail advertising channels, and a new agency model will gain more traction helping simplify this complexity.

The challenge for retailers will be a measurement one: if they lack the tools and capabilities to prove the value and lift of the advertising they are selling to brands, they will fail to achieve broad adoption. Hint: OptiMine provides these measurement capabilities for some of the largest retailers and can help you too.

6. Bonus Prediction: Brands that avoided deep marketing budget cuts in 2022 and 2023 will perform better and will recover faster coming out of economic pressures

Brands are under immense pressure to cut costs, especially if they cannot prove their marketing impacts on hard dollar outcomes. Finance teams go to discretionary spend first, making marketing teams the first target for cuts.

This is another measurement challenge. If a brand cannot properly measure its advertising impacts, it stands no chance in this tug-of-war with finance. The unfortunate reality is that brands that cut leave themselves exposed to smarter brands who can properly measure marketing, and they will lose market share in the process to these intelligence-armed competitors.

The next most unfortunate step in this process is slower recovery when economic conditions improve. Brands who cut will rebound slower and less robustly vs. brands who held their ground. This is precisely why OptiMine exists: to help brands know the value of these investments and help them with agile analytics to plan for what’s next. Don’t get cold feet and lose the fight for your budget. Show up with the right analytics and data to prove your value. We’re here to help.