Case Study: How OptiMine Helped Citibank Uncover Opportunities That Other Vendors Missed

01/22/2021

Industry:

Financial Services

Client:

Citibank

Background:

A large Fortune 25 bank selected OptiMine for agile marketing measurement and optimization because their then-current multi-touch attribution (“MTA”) and marketing mix modeling (“MMM”) vendors could not provide detailed measurement across both digital & traditional media for new customer acquisition across online, bank-branch and call center touchpoints. In the process of working with OptiMine, the brand also discovered it could use OptiMine to measure media contributions to the acquisition of high lifetime value (“LTV”) credit card holders – “Revolvers” versus lower LTV “Transactors.”

Challenge:

The bank faced a series of limitations with its then-current vendors:

1. Its MTA vendor only measured digital channels and match rates for offline were too low to be of use.

2. Its MMM vendor was too slow (refreshes took 2-3 months) and could not measure any channels in detail, thereby providing only very high level guidance that was not actionable.

3. The brand couldn’t read media contributions on the quality of new customer acquisition and was blind to the effects campaigns had on high and low quality new card holders.

4. Need for Agility: competitive factors required the bank to be faster and more flexible in its marketing measurement.

Solution:

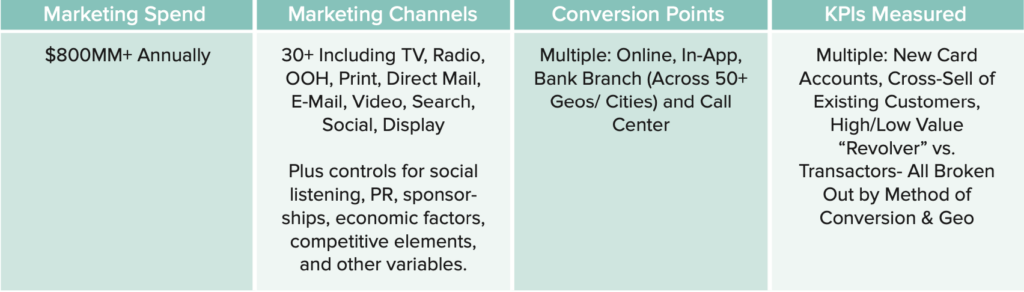

OptiMine was deployed in less than 8 weeks for an incredibly complex marketing environment and budget as follows:

Furthermore, the OptiMine solution measured 5-7 levels deeper than the existing vendors measuring down to campaign levels to provide 20+ global agency partners and internal marketing teams far more detailed optimization guidance than was previously available.

Results:

Deploying in less than 8 weeks, OptiMine immediately discovered $27MM in cost savings in low performing spend that was easily and safely reallocated to higher performing investments.

OptiMine also surfaced hundreds of deep channel-level optimization opportunities at campaign and ad levels that the bank’s other MTA and MMM vendors missed. Because the MTA and MMM vendors could not measure detailed campaign performance across the spectrum of digital and traditional media over the bank’s online, in-app, call center and in-branch acquisitions, they missed thousands of detailed ROI opportunities – opportunities that OptiMine discovered with its agile, high-scale analytics.

The bank’s MTA vendor missed significant opportunities because it had a blind spot for any offline conversions and could not measure traditional media. The bank’s MMM vendor could not perform detailed measurement within marketing channels and only provided high-level guidance. OptiMine solved these two shortcomings and delivered hidden, very significant ROI.

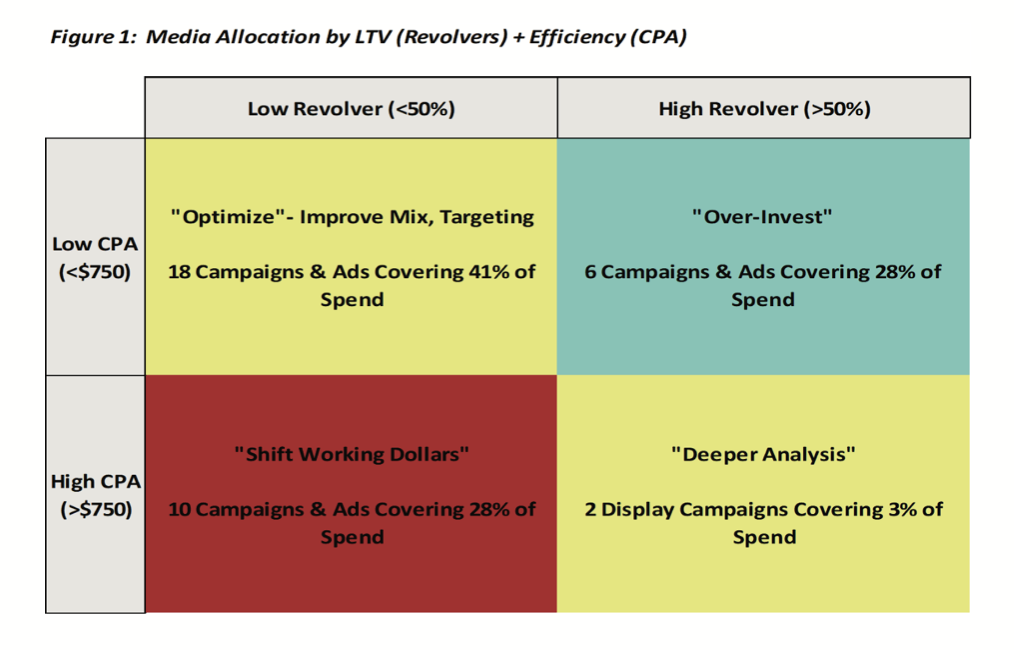

In a deep analysis of Digital Display, OptiMine uncovered a series of opportunities to optimize spend mix across dozens of campaigns and ads to target efforts on display investments yielding a positive mix of new Revolver accounts at lower than average CPAs (See Figure 1 below for a detailed look at this breakout). Additionally, OptiMine’s deeply detailed analytics surfaced:

- Campaigns that drove 7x the ratio of high value Revolvers

- Hidden pockets of value deep within branding-oriented spend driving high-value response and acquisition

When the bank provided new data on acquisitions by “Revolvers” and “Transactors,” OptiMine was able to quickly refresh models and measurement within 24 hours. The results were startling: the bank had never seen a detailed analysis of all marketing channels and their effects on the quality of newly acquired customers. The deeply detailed read allowed the bank to focus on core areas of opportunity:

- Quickly expanding investment in digital channels that produced higher ratios of high-quality new customer acquisition

- Funding the expansion by drawing budget from poorer performing marketing campaigns that were neither cost efficient from a CPA basis nor produced higher rations of high quality new customers

The bank’s newfound analytic agility powered by OptiMine allowed it to expand at the thought of business and dive deeper into branding investment opportunities by geographic market, explore ways to drive more efficient affiliate program management, and rationalize search portfolios based on deeper, more complete analyses enabled by OptiMine. That’s the OptiMine agile difference.

Click here to download the PDF version of this case study.

About OptiMine

OptiMine helps leading retailers measure the incremental contributions of their digital and traditional marketing campaigns on any outcome (sales, traffic, new customer acquisition and more) across any conversion point (in-store, e-commerce, in-app, call center and more). OptiMine’s privacy-forward approach means you’ll never need to compromise with tech industry and state-by-state privacy changes and regulations.