What Happens When Brands Stop Advertising?

01/08/2025

The pressure from finance is real: right about now is when the email from finance outlines the expected marketing budget cuts required for the new budget year. But it doesn’t need to be this way, and this pressure almost always stems from missing (or sub-par) marketing measurement and a lack of engagement and collaboration between the marketing and finance teams centered on the incremental impacts of marketing, both short and long-term.

Marketers believe intuitively that their investments impact the business but many times lack the ability to measure this impact precisely nor predict the outcomes of advertising reductions over time. Because of this, they lack the ability to push back on arbitrary budget reductions, and also lose the ability to engage with finance to work on more collaborative and intelligent budgeting and scenario planning. As a result: the marketing team forfeits the budgeting game and loses the battle with finance.

But it doesn’t have to be this way, and marketing teams need to do better in their pursuit of better budgeting and performance impacts on the business.

A Cautionary Tale (Two Actually)

OptiMine is in the business of measuring marketing impacts and helping guide brands to better decisions and stronger outcomes. OptiMine was in a unique position to evaluate the impacts of dramatic marketing budget reductions for two of the brands we work with: a major multi-brand retailer, and a large financial services company. The cuts were made over the past few years and OptiMine was able to analyze the business impacts of these decisions across a two-year time horizon. From a pure econometrics standpoint, it was the perfect opportunity to assess the immediate, medium and long-term impacts of these decisions across a set of critical business performance metrics. OptiMine is sharing these insights via a public case study as a cautionary tale (hint: the results were bad) to marketers and their finance partners about the damage these decisions can have and why having collaborative, modern marketing measurement framework is so mission critical.

The Pressure Starts with Poor Marketing Measurement

The pressure from finance starts when the marketing team cannot reliably and confidently produce evidence that demonstrates the incremental value of campaign investments, or when the evidence lacks credibility. Many marketing teams still rely on platform reporting (e.g. ad platform reporting showing how awesome the ad platform is performing), highly inaccurate multi-touch attribution approaches or web analytics that still rely on last-click. These all have severe issues and also tend to misstate or grossly overstate campaign contributions.

If you and your team are still using last-click / last-touch or click-based attribution: you need to stop. You are likely doing more harm than good. In fact, a recent research study from Northwestern University shows that error rates from these measurement approaches are as high as almost 500%. Yes, you read that correctly: 500%.

Put yourself in the finance team’s shoes: the marketing team produces all of the platform and web analytics reporting showing how great marketing campaigns are performing and the finance team cannot correlate any of it to actual business performance. What would you conclude if you were in finance? That marketing is working? This measurement reporting only serves to undermine the marketing team’s credibility and worse, may drive open hostility between the finance and marketing teams. One could say the worst case scenario is that the marketing budget gets cut, but frankly, if there’s no evidence to support the incremental impacts of marketing, then maybe one can’t argue this is the “worst case” scenario.

If finance doesn’t believe in the marketing measurement, then collaboration between marketing and finance becomes extremely difficult. Scenario planning to determine how best to allocate budgets and investments grinds to a halt and marketing teams are left exposed.

TLDR: Marketers are still using really poor measurement approaches that work against them. And by not having the right tools in hand, they stand no chance to push back against cuts.

What Happens When Brands Cut Advertising?

With the two brands’ dramatic budget reductions as a basis for our analyses, OptiMine was able to evaluate the impacts of these decisions across:

-

Immediate-Term: how the campaign investment reductions impacted the business in the first two months following the reductions.

-

Medium-Term: evaluating business impacts up to one year.

-

Long-Term: examining the business impacts up to two years and also determining the headwinds faced when the brands attempted to grow marketing spend after the reductions.

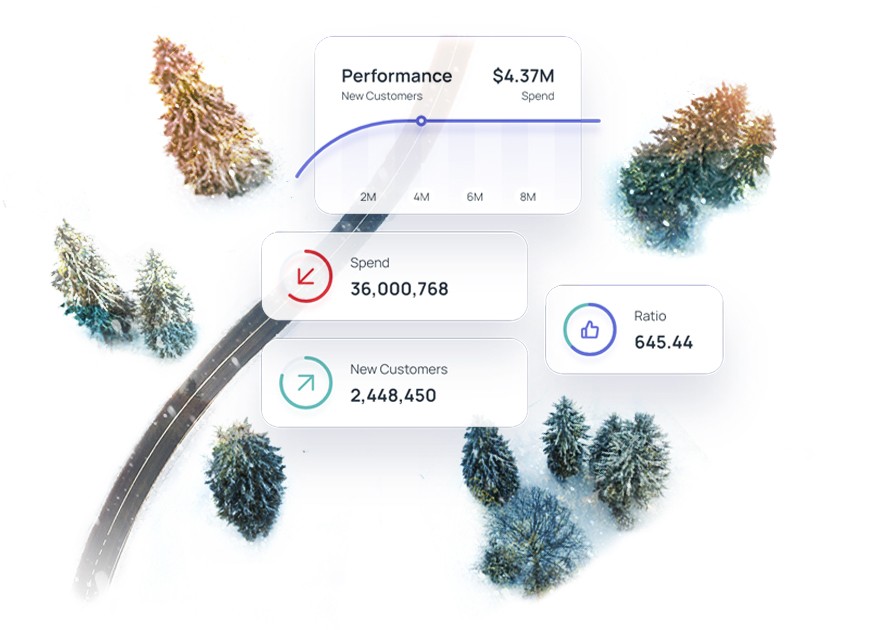

The immediate term impacts were, well immediate. Metrics like revenue and new customer acquisition dropped off instantly as expected. While the ad spend reductions varied between the two brands, the incremental revenue driven by marketing fell by over 50% on average.

Over the medium-term, these losses continued as advertising levels also continued at far lower rates than historical periods. Interestingly, while a shorter-term blip of ROAS improvement was seen (which was also expected since the brands were moving down the yield curve where more efficiency could be found), this only lasted for a short while and then ROAS continued to drop (by over 50%). This was due to a weakening of brand awareness which, in turn, made the brands’ media work harder to achieve lift.

Long-term, the results were very interesting. OptiMine saw that the hole dug by the advertising reductions created difficulty for the brands as they sought to re-build after the reductions. In other words, the economics of the advertising spend were far worse, even at the same levels immediately prior to the spend cuts. CPA’s were far higher and ROAS was far lower, reflecting a few long-term negative impacts of the budget cuts:

-

Brand Effects and Awareness: the brands suffered as a result of the spend reductions and this drove brand awareness down making it even more expensive to re-enter the market.

-

Competitive Headwinds: the brands’ competitors didn’t reduce their spend during the same time period, and presumably gained market share and customer takeaways, creating more difficulty (and expense) to win back the competitive market space.

These Impacts are “Knowable” in Advance

By using agile, advanced marketing measurement like OptiMine, brands can estimate and know what these impacts will be prior to making such decisions. This is one of the most important points as it relates to the potential collaboration between marketing and finance. Our best performing clients have healthy finance participation in the marketing measurement decisioning processes because the finance team can work alongside marketing and perform scenario plans to determine outcomes well in advance. This raises confidence, improves decision quality, and generally protects brands from arbitrary and damaging budget cuts that create huge business problems down the road.

Interested in the case study and the full details of what happened to these brands? Download OptiMine’s “What Happens When Brands Go Dark” case study below: